amazon Express Accounts Accounting reviews

Express Accounts Accounting is a complete accounting solution for small to medium businesses (SMB) to manage its financial transactions, manage expenses and perform various financial reporting activities. This review will address the salient features, usability, benefits, limitations, pricing, customer support, and overall suitability of Express Accounts Accounting to aspiring businesses seeking efficient and reliable accounting solutions.

Salient Features of Express Accounts Accounting

1. Financial Management

Express Accounts Accounting offers the basic necessary financial management equipment to track income, expenditures, accounts payable (AP), and accounts receivable (AR). Users will record everyday business financial transactions in detail, categorize expenses, and reconcile bank accounts in order to maintain financial accuracy.

2. Invoicing and Billing

The software provides invoicing and billing features to enable professional invoices quoting and estimating for clients and customers. Users can personalize invoices with their company’s logos, payment terms, and item particulars. Automated reminders also help make the collection of payments more efficient and improve cash flow management.

3. Expense Tracking

Business expenses can be recorded, and expenditures can be broken down, along with tracking of purchase orders for ease of use. Users are further able to easily track their stealing and compare expenses to specific projects or departments and create financial analysis expense reports.

4. Financial Reporting

The software can build a complete financial report, containing profit and loss, balance sheets, cash flow statements, and customizable financial summary statements. Reporting instruments provide business performance, financial health, profitability trends, and related metrics to encourage sound decision making.

5. Bank Reconciliation

Express Accounts Accounting makes bank reconciliation easy by matching the financial transactions with the bank statements. The user reconciles accounts, sees the discrepancies, and makes sure everything is accurate within the financial records. Bank reconciliation functions simplified auditing processes as well as enhance financial transparency.

6. Multiple Currency Support

The software deals with multiple transactions under one roof. A business can conduct international sales, incur expenses, and make conversions into the foreign currency. Therefore, multi-currency functions are a necessity to run businesses in the global context without exposing them to the international currency exchange risks and in compliance with international accounting standards.

7. Management of Payroll

The software provides very basic payroll processing functionalities in Express Accounts Accounting that can calculate the wages and deductions of the employee as well as determine payroll taxes levied wholly on employees. Payroll itself is managed using the software, generates employees’ pay stubs, and keeps employee pay records that meet tax requirements. The integration with payroll services provides members with accurate accounts for payroll processing and tax filing.

8. Security and Compliance

Data security is one of the main focuses of the software, which provides password protection, user permissions, and data encryption for any sensitive financial data. Express Accounts Accounting complies with the necessary financial regulations like Generally Accepted Accounting Principles (GAAP) to maintain the integrity of data and its compliance with regulations.

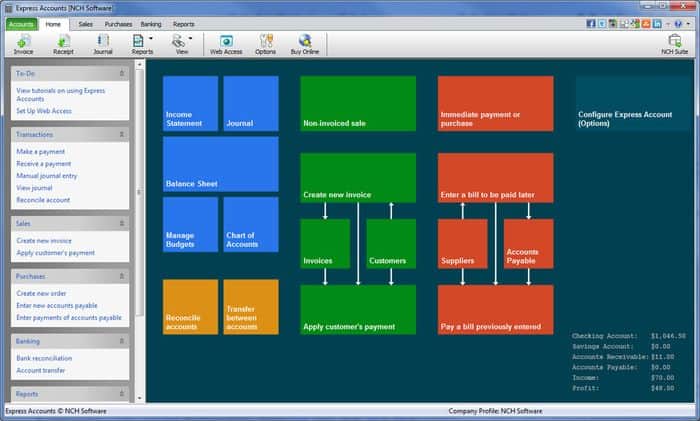

Usability and UI

The User Interface is User-Friendly

Express Accounts Accounting has an easily navigable graphical user interface. The dashboard gives an overview of finances, starting with transactions, through account summaries, to important financial metrics consolidated into one view. Dashboards which are customizable, shortcut menus, and interactive graphs further improve user experience and productivity.

Customization Options

The software allows for customization options so that accounting processes and reports can be tailored according to certain business requirements. Users can modify charts of accounts, create custom invoice templates, set up recurring transactions, and personalize financial reports to meet organizational needs.

Accessibility

Express Accounts Accounting is available for download as a desktop application for Windows and macOS; hence, it is compatible with most operating systems. The cloud-based version or mobile apps for iOs or Android devices can be used to handle finances, print reports, and track expenses, thus offering much flexibility and mobility.

Benefits of Express Accounts Accounting

1. Enhanced Management of Financials

Express Accounts Accounting allows financial management by automating accounting functions such as invoicing, time tracking, and bank reconciliation. The program enhances efficiency, reduces manual errors, and frees more time for routine financial operations.

2. Enhancement in Cash Flow Management

The software monitors income and expenses in real-time, manages repayment deadlines, and sends automated reminders using invoices to take cash flow management up a notch. Companies are able to see their cash flows and use it to optimize their working capital and maintain their financial status.

3. Financial Clarity and Reporting

The Express Accounts Accounting tool allows real-time financial clarity with customizable reports and financial dashboards. Users can now assess business performance, spot trends, and make well-informed decisions that enhance profitability and growth.

4. Cost Management

With Express Accounts Accounting, the software contributes to the minimization of operational costs emanating from manual accounting operations, paper trading, and financial reporting. The saving of operational costs and efficiency is ensured through automation of repetitive tasks, integration with banking systems, and cost-effective expense management.

5. Scalability and Integration

Express Accounts Accounting is noted for scalability that will accommodate the company’s growth and expanding accounting needs. It integrates with other business applications such as inventory management software, CRM systems, and payroll services for seamless data synchronization and improved workflow productivity.

Drawbacks and Considerations

1. Limitations of Advanced Features

Express Accounts Accounting may not have advanced features suited for larger corporations or specialized industries such as advanced inventory management, project costing, or complex financial forecasting capabilities.

2. Customer Support

The customer support efficiency may vary according to subscription plans or levels of service. Businesses should consider details on available support channels, response times, and accessibility for timely assistance and resolution of technical issues.

3. Learning Curve

New users may encounter a different learning curve when working through features, setting up accounting procedures, and producing financial reports. Training resources, user guides, and continued support are vital to help in the adoption of the software and ensuring the most functionality.

Industry Applications of Express Accounts Accounting

Express Accounts Accounting is applicable in different industry sectors and under many applications which are the following:

Retail.

Retail use Express Accounts Accounting for sales tracking, inventory management, and financial reporting. The software accommodates retail accounting requirements such as POS integration and sales tax handling.

Professional Services.

Consulting firms, legal practices, and freelance professionals utilize Express Accounts Accounting billing their clients for project accounting and timekeeping. It allows for accurate invoicing, expense reimbursement, and client account management.

Hospitality.

Hotels, restaurants, and all other kinds of businesses in the hospitality sector use Express Accounts Accounting for planning budgets, tracking expenses, and financial forecasting. This software also accommodates certain accounting needs specific to the hospitality industry, such as revenue management for rooms and guest billing.

Nonprofit Organizations.

Nonprofit organizations use Express Accounts Accounting to manage donor contributions, grant funding, and expenses for programs. The software assists with fund accounting, compliance reporting, and transparency in financial management.

where can you get a Express Accounts Accounting online

Express Accounts Accounting Software for Bookkeeping, Cashflow and Reporting: Buy it now

Security and Data Privacy

Express Accounts Accounting takes data security and privacy seriously, providing secure access, encryption, and data backup mechanisms. The program is designed to meet various data protection laws, like GDPR and CCPA, in order to protect sensitive financial information.

Customer Support and Resources

Technical Support

Express Accounts Accounting Customer Support is available via phone support, email ticketing, and chat. The technical support team provides assistance with software installation, configuration, troubleshooting, and software updates.

Training and Resources

To give users a complete understanding of the features and functionalities of Express Accounts Accounting, the software has provided training materials such as user manuals, video tutorials, and knowledge-base articles. The training sessions are expected to relate to accounting best practices, practical financial management inputs, and optimization of the system.

User Community

Express Accounts Accounting promotes a user community through forums, user groups, and online communities where customers can discuss ideas, share accounting tips, and work together on financial management strategies. Engagement in the community gives peer support, networking opportunities, and feeds back for product improvement.

Conclusion

Express Accounts Accounting is a flexible accounting software product that can help integrate financial management, enhance cash flow visibility, and promote informed decision-making by SMBs in a variety of industries. With robust features, ease of use, and scalability, Express Accounts Accounting has given businesses the power to automate accounting processes, monitor income and expenses, generate financial statements, and comply with regulations in their jurisdictions.

However, Express Accounts Accounting incurs other issues, namely limitations of advanced features versus requirements, quality of customer support, and hassle of adoption and implementation. These should be weighed before determining suitability. On the whole, Express Accounts Accounting continues to be an important platform for SMBs in optimizing their financial operations, fostering business growth, and realizing sustainable financial success through good accounting practices.